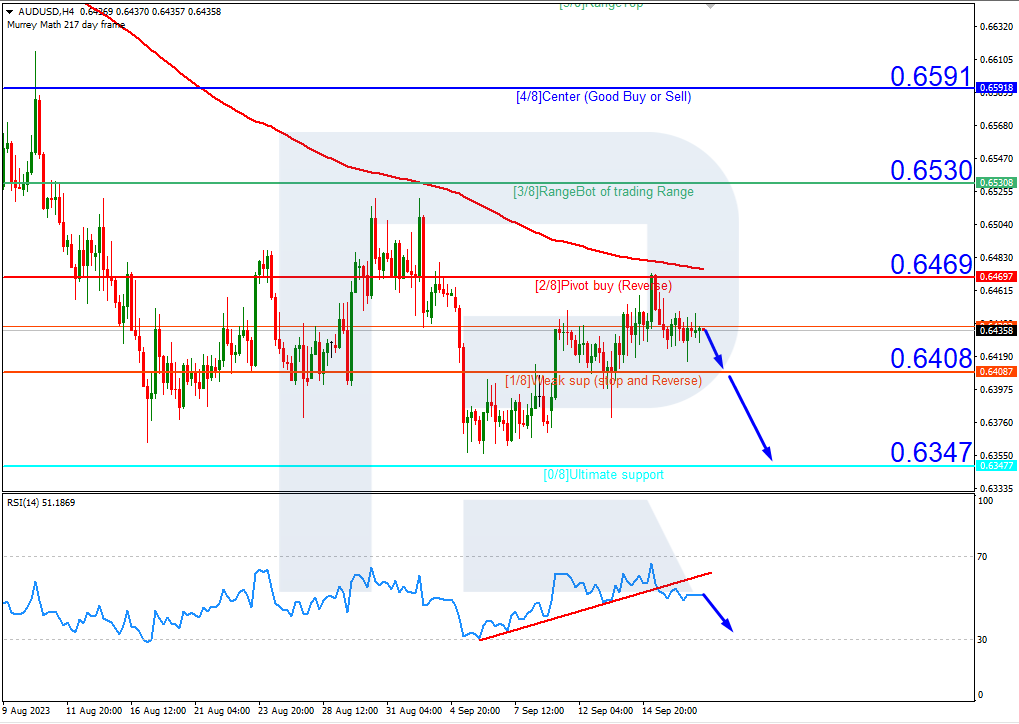

AUD/USD, “Australian Dollar vs US Dollar”

AUD/USD quotes are under the 200-day Moving Average on H4, indicating the prevalence of a downtrend. The RSI has broken the support line. In this situation, a test of the 1/8 (0.6408) level is expected, followed by its breakout and a decline to 0/8 (0.6347). The scenario can be cancelled by rising above 2/8 (0.6469), which might lead to a trend reversal and make the pair rise to the resistance level of 3/8 (0.6530).

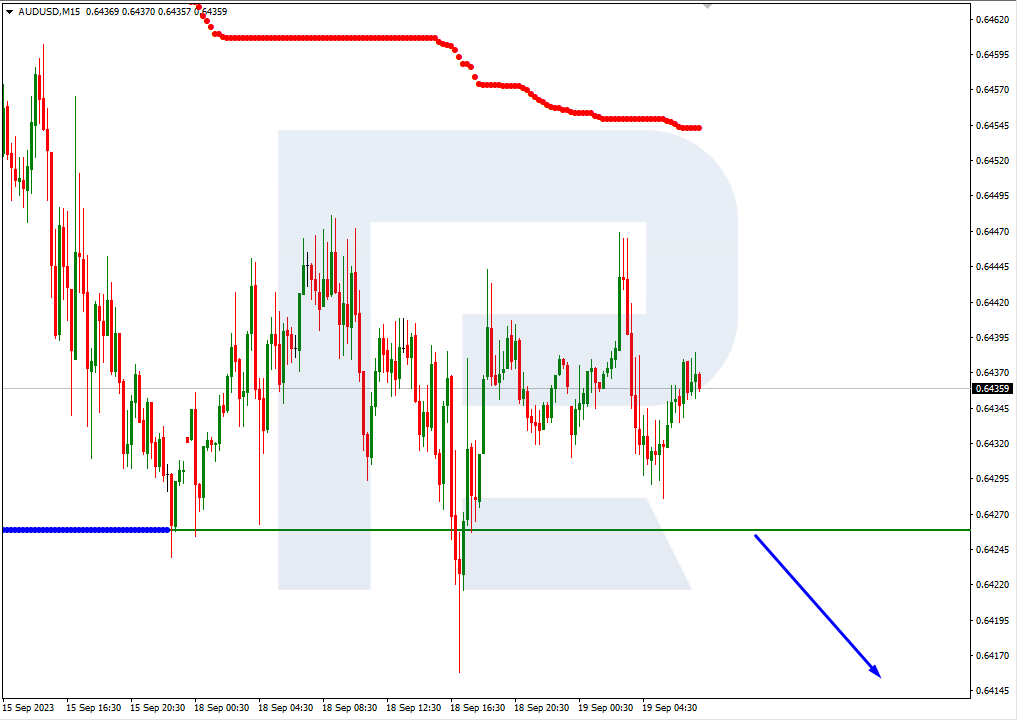

On M15, the price decline could be additionally supported by a breakout of the lower boundary of the VoltyChannel.

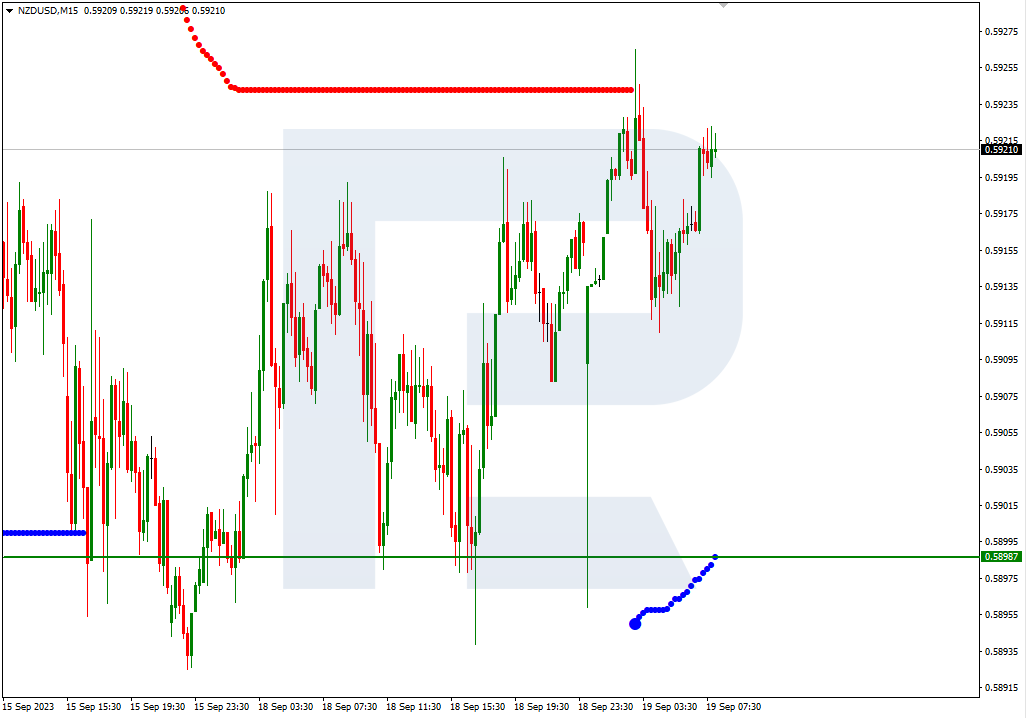

NZD/USD, “New Zealand Dollar vs US Dollar”

NZD/USD quotes are under the 200-day Moving Average on H4, indicating the prevalence of a downtrend. The RSI has broken the support line. In this situation, a rebound from 1/8 (0.5920) is expected, followed by a decline to the support at 0/8 (0.5859). The scenario can be cancelled by rising above the resistance at 1/8 (0.59820). In this case, the pair might climb to 2/8 (0.5981).

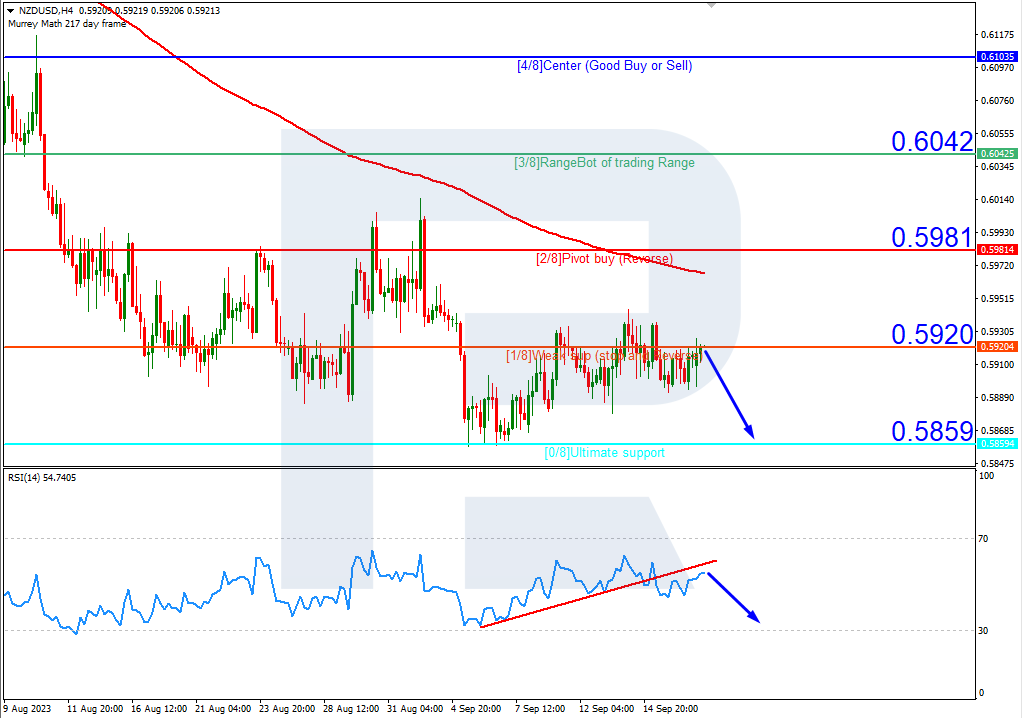

On M15, the lower boundary of the VoltyChannel is too far from the current price, hence, the price decline could be supported by a rebound from 1/8 (0.5920) on H4.